Nuclear plants are grotesquely capital intensive and expensive at almost all stages of the fuel cycle, especially construction, fuel reprocessing, waste storage, decommissioning, and R&D on new nuclear technology. These exceptionally high costs are connected, in part, to the history of nuclear power itself, as neither the United States nor France—two countries largely responsible for developing nuclear power—pursued nuclear power generators for their cost effectiveness.Now current reactors produce electricity is at a very low cost. These arguments are usually quite superficial and do not engage in good faith efforts to compare nuclear costs with other with the cost of producing electricity from other post-carbon electrical sources. Indeed advocates of all renewable generation systems almost never discuss the current or future costs of those systems. Indeed they often ignore the current price of renewable facilities, and usually ignore the cost of redundancy and energy storage, as well the cost of building new grid extensions. For example California plans a

$3.3 billion initiative aiming to install 3,000 MW of new grid connected solar capacity over the following decaideThat means that for every 1000 MWs of solar generating capacity added to the California electrical system the state will be spending $1100 million. Renewables advocates often speak of a smart grid, without saying what a smart grid system will cost. While a smart grid will undoubtedly enhance the current grid system, it will not compensate for the limitations of renewables geneerating systems, and impliminting a smart grid system will carry substantial costs.

I have attempted at Nuclear Green to report on current renewables cost, with some systamatic attemptes to estimate the cost of building a reliable base power or a reliable peak power source given the cost of current renewable technology. I have also indicated that future costs arevery uncertain because of the sudden and drastic economic crash of 2008, a crash whose magnitued we are just now beginning to appreciate.

Sovaciool and Cooper offer us the following statement on nuclear costs:

New evidence suggests that the estimate of $2000 per installed kW reported by the industry is extremely conservative and woefully out of date. Researchers from the Keystone Center, a nonpartisan think tank, consulted with representatives from twenty-seven nuclear power companies and contractors, and concluded in June 2007 that the cost for building new reactors would be between $3600 and $4000 per installed kW, with interest.167 Projected operating costs for these plants would be remarkably expensive: 30¢/kWh for the first thirteen years until construction costs are paid followed by 18¢/kWh over the remaining life-time of the plant.168 Just a few months later, in October 2007, Moody’s Investor Service projected even higher operating costs, an assessment easily explained by the quickly escalating price of metals, forgings, other materials, and labor needed to construct reactors.169 They estimated total costs for new plants, including interest, at between $5000 and $6000 per installed kW.170 Florida Power & Light informed the Florida Public Service Commission in December 2007 that they estimated the cost for building two new nuclear units at Turkey Point in South Florida to be $8000 per installed kW, or a shocking $24 billion.171 Most recently, in early 2008, Progress Energy pegged its cost estimates for two new units in Florida to be about $14 billion plus an additional $3 billion for transmission andNote that this discussion notes that overnigh costs in 2007 were estimated to run perhaps $4000 per kw of generating capacity. The assumption is that it would be outrageous to pay so muchy money for electrical generating capacity. But is it? Consider the cost of solar thermal power. In a small solar thermal facility under construction in Spain 2008 was reported by the Guardian to cost 80 Millions Euros, ($108 Million) and to produce a maximim of 20 MWs of power. Now it would take a facility that was 50 times larger to produce the same power output as a typical reactor. How much would it cost to produce reactror size outputs? If we uped the output of our solar facility to 1000 Million watts the resulting building cost would be $5.4 billion. If we tacked on the grid connection cost of $1.1 Billion, our costs now run runs to$6.5 billion. But such a facility would have a capacity factor of around .20 verses a capacity factor of .92 for the reactor. That means that the solar facility produces only 22% of the electricity the reactor does on an annual basis. In order to produce the same amount of electricity we will have to enlarge our solar field to 4 1/2 times times the size of the original facilityfacility and add some form of over night storage for the extra heat. This would cost somewhere between 20 and 25 billion dollars, and does not include the S1.1 billion extra for the grid hookup. Now that is grotesquely capital intensive.

distribution (“T&D”).172

We see that even without inflation that duplicating the power output with some solar thermal technologies will be far more expensive than nuclear. I as of yet have not written off all solar thermal technologies, but some are clearly extremely expensive, and likely to become for so if the 2002 to 2007 inflation in power generating facilities construction costs emerges again in a few years. It should be noted that no solar thermal technology has yet been proven to be cost competitive with nuclear on the basis of actual construction costs for actual rather than theoretical capacity. Nuclear facilities produce over 90% of their rated power over a year while solar facilities produce power, 18% to 22% of their rated power annually. Thus in order to produce as much power as a nuclear facility, the power gathering field has to be enlarged by at least a factor of 4, and expensive heat storage technology has to be added to the solar facility. Thus while solar technology is cheaper by rated capacity, but rated capacity is highly deceptive. Solar facilities only produce at rated capackty for a short period a day, and generate no electricity at all for most of the day. It is not cheaper if measured by actual power output to build solar facilities rather than reactors.

Sovacool & Cooper devote most of their discussion of cost to a discussion of cost over runs in reactor discussion, that is remarkably devoid of insight into the cause of those over runs. Reactor construction costs drop with serial production of reactors. Also the purchaser's familiarity with reactor construction is important. Finally, a large construction project like building a reactor, requires great managerial skills. In order to control shus a large and complex process, managers themselves need specialized training.

In fact, during the first nuclear era, relatively unskilled managers, were overwealmed with their assignments. No less that four reactor manufacturers vied for sales of evolving reactor designs. In many cases the detailed construction design was incomplete when the reactor construction began, and the design was revised during construction, requiring that completed parts of the facility already completed be torn down and rebuilt. After Three Mile Island, changing safety regulations required major design changes to facilities already under construction. Often this ment that much of the reactor and its facilities had to be torn down and rebuilt for a second time. Prolonging the construction project meant that interest was accruing without any revenue, thus money had to be borrowed to pay interest.

There are of course lessons from the experience that could be learned. Sovacool & Cooper who only talke the most superficial of looks learn none. But the French, the Japanese, and the South Koreans did. They used mature reactor designs, which already contained advanced safety features. Construction managers were well trained, and reactor construction projects were completed on time or sooner and at or under budget. thus contrary to Sovacool & Cooper the pattern of cost over runs appears to be be a localized problem in North America.

Is it possible then for American reactors be built on time and within their budgets? Certainly, but the reactor builders need to larn the lessons. One of the roles of scholars in studying the history of technology is to point out useful lessons to be learned. However, anti-nuclear fanatics like Sovacool & Cooper refuse to even consider the possibility that cost management lessons are available from the history they recite. Hidden in their argument is a profound contempt for history and the possibility that human practices can evolve and change as people face problems and overcome them.

Sovacool & Cooper commit a second intellectual failure, they ignore the construction cost inflation that occurred between 2002 and 2007. During that time, enoumous construction projects in Asia, drained huge amounts of resources from the construction industry, doubling the cost of energy related construction during those years. This effected not only the price of nuclear power plans, but also the price of coal fired power plants, and wind generators as well. Reactor construction cost estimates from 2008 usually assumed a continuation of the similar inflation patterns out to 2012, the earliest date which new reactor construction could begin in the United States. The same inflation pattern that was projected to effect the cost of nuclear construction would have undoubtedly effected the cost of solar and wind projects as well, and at least to the same degree. Thus the cost differential for unit of power produced between nuclear renewables would still hold.

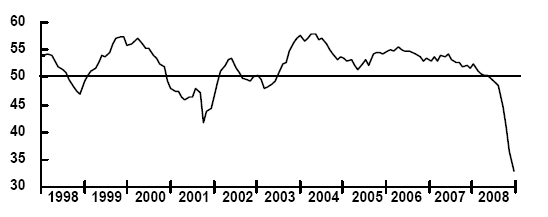

However, the great economic crash of 2008 has already greatly impacted the pace of new construction world wide. The following chart illustrates the dramatic economic drop that occurred during the last year:

It would appear that the crash of 2008 will require sometime before complete recovery commences. It is not clear how long the period of negative or depressed economic growth will last, but one impact of any economic downturn as drastic as the one we just experienced, will be a lowering of the cost of all new electrical generating facilities, including the cost of reactors. I will not fault Sovacool & Cooper for their failure to notice this, since I made assumptions of continued cost inflation until recently.

Sovacool & Cooper point to factors such as "operational learning" which they describe as

a feature not well suited to rapidly changing technology . . .But it is far from clear how much a factor "operational learning" will be in new reactor costs. Recent changes inb reactor technology are evolutionary rather revolutionary in nature. The Light water reactor is a mature technnology, that is not rapidly changing. Furthermore, new American reactors will be based on designs that will be built elsewhere first. Thus much of the cost of "operational learning" will be born by the Chinese, the Japanese, the Fins, and the French. Sovacool & Cooper also note

difficulty in standardizing new nuclear unitsA problem which I already touched on, but that problem may well be a thing of the past. First Many power producers appear to be focusing on a relatively few designs. The Westinghouse AP-1000 is particularly attractive, and China has already standardized the Ap-1000 as its standard reactor design. Numerous American power producers are considering the AP-1000 and it is also under consideration in England.

Sovacool & Cooper also focus on the cost of fuel reprocessing. The principle economic argument against reprocessing nuclear fuel is that it is cheaper to mine new uranium, enrich it, and run it through a once through cycle, and then designate it nuclear waste. But in terms of power production cost, recycling nuclear fuel would add very little to final electrical costs. Sovacool & Cooper do not understand this. They assert,

Researchers have recently proposed a newer method of reprocessing called uranium extraction plus (“UREX+”), which keeps uranium and plutonium together in the fuel cycle to avoid separating out pure plutonium. This method, however, is both unproven and absurdly expensive. The DOE estimated in 1999 that it would cost $279 billion over a 118-year period to fully implement a reprocessing and recycling program for the existing inventory of U.S. spent fuel relying on UREX+.Is $279 billion spread over 118 years absurdly expensive? We have an annual expense of 2,364,000,ooo a year which seems like a lot of money, but the total sum is less than what the United States paid for imported oil in 2007. But the energy return on the investment in nuclear fuel recycling would be many times higher than the energy return on dollars spent for imported oil. Further more dollars spent on recycling American nuclear fuel are not spent on imported fuel. Money spent on energy producing industrial process in the United States is money that is not lost to the American economy. Economic multipliers would come into play, further lowering the real economic cost of fuel reprocessing.

Reprocessing is also economically rational because it is cheaper and safer to recycle used nuclear fuel than to treat it as nuclear waste than to place it into long term storage. U-235 and plutonium found in nuclear fuel can used to fuel two types of Generation IV reactors, The Liquid Fluoride Thorium Reactor, and the Intrigel Fast Reactor. Contrary to Sovacool and Cooper's claim that

Generation IV reactors entailed much higher reprocessing and disposal costs compared to conventional recycling and fuel disposal . . .the LFTR reprocesses fuel internally, and can be used as a means of disposing of nuclear waste from other reactors. In fact, as I note elsewhere on this blog, uranium and plutonium from nuclear waste can be used as a starter charge, for new LFTRs. Used this way, the cost of reprocessing "spent nuclear fuel", which Sovacool & Cooper also state to be $5 billion a year, would far more than pay for itself in terms of the energy reprocessing would return to the economy. This is one of the many instances in which the Sovacool & Cooper analysis goes completely astray by its failure to put the facts into context.

Sovacool & Cooper and make the cost of long term storage of "nuclear waste" an issue. i personally would regard the disposal of spent reactor fuel a tragedy, since 99% of the potential energy in uranium goes unused in reactors. Sovacool & Cooper, obcessed as they are in demonstrating their case against nuclear power at every turn fail to compare the cost and benefits of reprocessing with the cost and benefits of long term storage.

Sovacool & Cooper raise and misrepresent the question of nuclear decommissioning. First Sovacool & Cooper misinform us on the lifetime of nuclear plants:

Nuclear plants often have an operating

lifetime of forty years.Iin fact it is at least 60 years with another 20 opening up as a possibility. Thus the statement that

In most cases, the decommissioning process takes twice as long as the time the reactor is actually in useis inaccurate no matter what its source. Their statement that reactor decommissioning

costs anywhere from $300 million to $5.6 billion.reports fact but ignores that nuclear decommissioning costs are set asside during the 60 to 80 years that a reactor is operated, and thus does is already paid for when decommissioning begins. Paying decommission cost does not pose a serious burden on rate payers, because decommissioning costs are only a very tiny fraction of each cent paid for electricity. Sovacool & Cooper appear to feel uncomfortaboe withtheir cost od decommissioning in the united States, because they includ a discussion of the cost of decommissioning, for British zreactors, and a second discussion of the cost of decommissioning K-25 a World War II era, weapons related industrial facility in Oak Ridge.

Sovacool & Cooper also provide a wholly wrong headed analysis of nuclear research and development. Thus their assessment of Generation IV nuclear technology simply groups all generatiohn IV together as a group and characterized them. This is most unfortunate in the case of the LFTR because of its radical difference from other reactor technologies. Thus many things that Sovacool & Cooper say about GenerationIV Nuclear technology are not true of LFTR technology. This is especially hard to explain becaus Ben Sovacool is familiar with my blog, Nuclear Green afnd has commented on it on a number of occasions. Ben is also aware of Energy from Thorium, a blog that has what can only be described as a tremendous factual basis. Asside form category errors, Sovacool & Cooper offer the argument that sinceGenerationIV Reactors need to be researched before they aree built, they shouldnot be researched. Is there an explanation for this circular conclusion? yes, It is clear that Socacool & Cooper regard any reactor belonging to the generation IV reactor class as bab, bab, bad.

Finally we have the matter of subsidies. First I should note a distinction between the civilian nuclear industry and the civilian nuclear power industry. The Civilian nuclear Industry is a refers to all research conducted to on topics deemed to be of use to civilians. This might include everything form the peaceful uses of nuclear explosions, to the use of radioisotopes in medicine, the use of radiation to trigger genetic mutations in plants, the study of Carbon-14 inthe atmosphere, and many other research issues not directly baring on nuclear power. Secondly, it should be observed that many of the so called civilian research projects had secret military purposes. The distinction between civilian and military research was nearly as hard and fast as it would appear. For example the first civilian nuclear power plant, the Shippingport Reactor, was actually a Naval Reactor. During its history the Navy used the Shippingport reactor for expeeriments. The Navy exercized a great deal of controlover the USAEC during the 1950's, 60's and 70's. and many of what might appear to be civilian research decisions were actually made for military purposes. Thus for example the decision to research the liquid Metal Fast Breeder reactor rather than the safer and largely waste free molten salt reactor, appears to have been made with an eye to the production of plutonium for military purposes. Plutonium is a relatively unsatisfactory thermal reactor fuel, but PU-239 is a preferred weapons material.

Direct research in support of the civilian power industry has been quite small. The Federeal government spent about 5.8 billion dollars developing the civilian version of the light water reactor. This was the largest single subsidy which it provided the civilian nuclear power industry. A second significant subsidy will come into force during the next decade when the Federal government is committed to cosign loans worth 18 Billion Dollars for the Nuclear power industry. It is frequently argued that the Anderson-Price Act is a subsidy to the nuclear power industry. But in fact the the Anderson-Price Act indemnifies the nuclear Industry for at least$10 Billion in the event of a nuclear accident, and leaves open the possibility of an even higher bill to reactor owners, if the total recovery costs exceeds $10 Billion.

Unlike the renewables, the nuclear power industry does not get any tax breaks on its power production. Nor does federal government pay part of the capital costs of nuclear projects. Where then is the huge subsidy to the nuclear power industry that Sovacool & Cooper go on and on about. The huge nuclear subsidy is an urban myth perpetuated by anti nuclear fanatics. the truth is that high priced, low performance renewables can't cut it in the open market where nuclear is doing just fine. With out their subsidies renewable owners would simply fold their tents and slip into the night.

2 comments:

This one would be REAL good for the Kos Charels. Part II.

David

This is a good analysis!

If only it could be improved by a little spell-checking, though, people will be much more likely to respond positively and believe the arguments within.

Post a Comment