There are five substantial areas of risk faced by developers of new nuclear power stations. Three of those risk areas are so big and significant that if they go wrong, the developer (even the biggest utilities) could be financially damaged beyond repair. These risks can be classed as Corporate Killers. . .Panning, that is the time and money that go into nuclear plans, into acquiring the nuclear site represents the first risk, because the plan might fall through, but

While annoying for the developers if this turns out to be wasted time and money, in no way would a failed planning application threaten the financial integrity of a utility company.Similarly, a risk which the report calls "Decommissioning / Waste" is controllable if the right steps are taken. But Citigroup finds that this risk is also manageable through use of

a tax will be paid on each MWh produced (probably as little as £1/MWh). This would effectively limit the risk faced by the developers.This leaves us with three serious risks. First is construction

Below we give the latest data on the current and future costs of building a new nuclear power station. The latest evidence suggests a cost range of €2,500/kW to €3,500/Kw. For a 1,600MW unit, that means a construction cost of up to €5.6bn. We see very little prospect of these costs falling and every likelihood of them rising further. The cost of the TVO plant in Finland has increased from €3.0bn to €5.3bn since construction started. It has also proven to be very difficult to predict how long a new plant will take to build. The TVO plant is also running three years late. Cost overruns and time slippages of even a fraction seen by TVO would be more than enough to destroy the equity value (and more) of a developer’s investment unless these costs can be passed through somehow. Given the scale of these costs, a construction programme that goes badly wrong could seriously damage the finances of even the largest utility companies.The second risk factor which Citigroup sees as a problem is power price

Nuclear power stations have very high fixed costs and relatively low variable costs. Their cash flows and profitability are therefore particularly sensitive to the price that they sell their power. As we show later, even at the low end of the build cost estimates, we calculate that a new nuclear station will require €65/MWh (£58.5/MWh) in real terms year in/year out to hit its breakeven hurdle rate. . . . the UK has only seen prices at that level on a sustained basis for 20 months of the last 115 months. It was a sudden drop in power prices that drove British Energy to the brink of bankruptcy in 2003. No nuclear power station has ever been built to our knowledge where the developer takes the power price risk.The final risk factor which Citigroup calculates is unexpected operational costs.

Because of their high fixed cost base, nuclear stations are also very vulnerable to shortfalls in output due to operational unreliability. A six-month breakdown can cost £100m’s in direct costs and lost output, particularly if the output has been pre-sold. This risk is too great for a single project to bear, in our view, and at the very least needs to be spread across a portfolio of assets.There are, however, both shorter and longer range solutions to these Citigroup risks. The first and the third risks can be overcome by a government run insurance pool. Reactor constructors pay into the pool, which issues loan guarantees. Initially the guarantees would have to be backed by the government, but as the pool builds up, it would be able to pay off losses either on construction or prolonged operational shutdowns. The rational for this is simple. Just as wind and solar, which are fare more dubious AGW mitigation approaches, have investor risks lowered by substantial government subsidies, the risks entailed by nuclear investments can and should overcome controlled by government action as well. Loan guarantees are a low cost means by which the Government can mitigate the risk of nuclear investors.

A loan insurance pool is a short run means of controlling the loan related risks of nuclear constructors. Longer run means would involve a number of changes in the way reactors are built, and by the introduction of a radical new nuclear technology, that involves a complete redesign of the reactor. As for the price risk, this is a puzzling point, because all alternatives to nuclear power, either carry unacceptable carbon related problems that present even bigger risks to potential investors, political risks or actually will cost more, and lead to even higher electrical costs than would be the case with nuclear power. It seems unlikely than any of the acceptable electrical generation options from the carbon emissions perspective will cost less than nuclear generated electricity.

From a slightly longer range perspective, the small reactor approach will offer substantial relief quite aside from the loan guarantee insurance pool. In a recent Toronto Star column Tyler Hamilton pointed to small reactors as a potential solution to the loan risk problems of nuclear financing. Tyler quotes American Nuclear Society President, Tom Sanders, who argued that small reactors would do for reactors

what Henry Ford did for carsHamilton commented:

The result is that economies of scale are replaced by economies of volume that come from assembly line manufacturing.Factory built reactors could be shipped in large componants by truck, rail or barge, and assembled on reactor construction sites, with what Hamilton calls a,

Lego block approach.Other cost saving ideas include building

them in a factory setting using robotic assembly, . . . The reactors would be low maintenance, have passive safety features, and would be buried underground.Hamilton did not mention recycling old coal fired power plant sites, an approach that could save tens or even hundreds of millions of dollars in side development costs. I have been told that Babcock & Wilcox, the only surviving American Owned reactor manufacture plans to to use all of these money saving approaches. B&W plans to cluster small reactors, rather than to build big reactors. Reactor owners could add more reactors to the cluster as electrical demand increases.

Small reactors would cost proportionately less than large reactors, and thus their financing is not a "bet the farm" proposition. A cluster of small reactors can be purchased one at a time, as it the purchase of each becomes easily affordable. There is a hidden economic advantage to the small reactor - coal yard approach. Grid expansion costs, often associated with the construction of large reactors can be avoided. The construction of new high tension power lines, need to reach electrical customers from some new large reactor projects, and large scale renewables projects, can cost up to $3 billion dollars. Coal fired power plants already have grid hookups available. All you have to do is swap out generation sources.

The small reactor cluster also is an effective counter to the the operational risk problem. If one reactor goes down for a prolong period of time, there would still be a stream of income from the other reactors in the cluster.

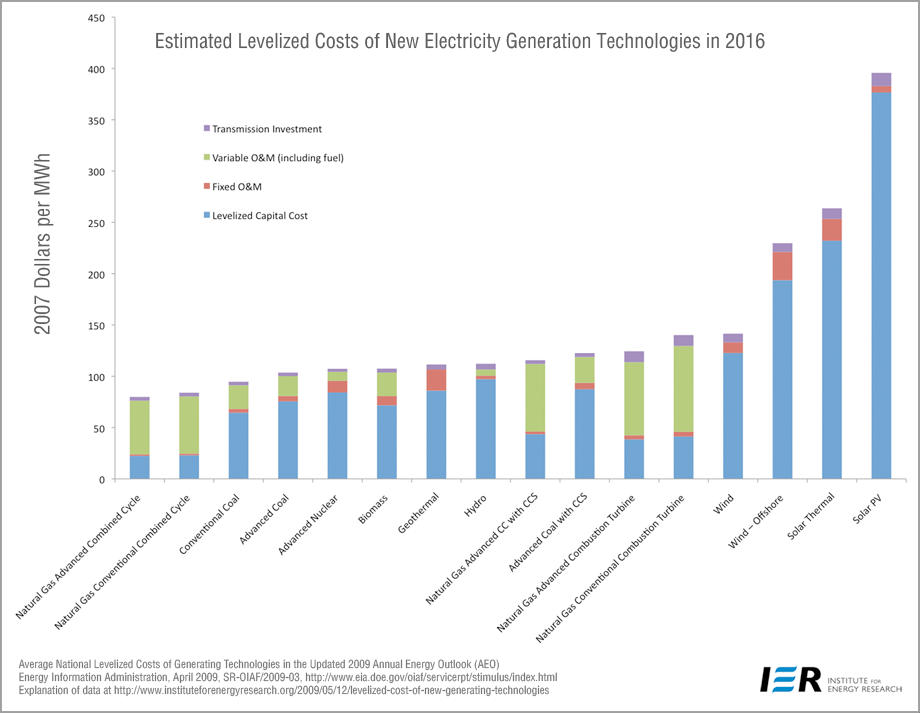

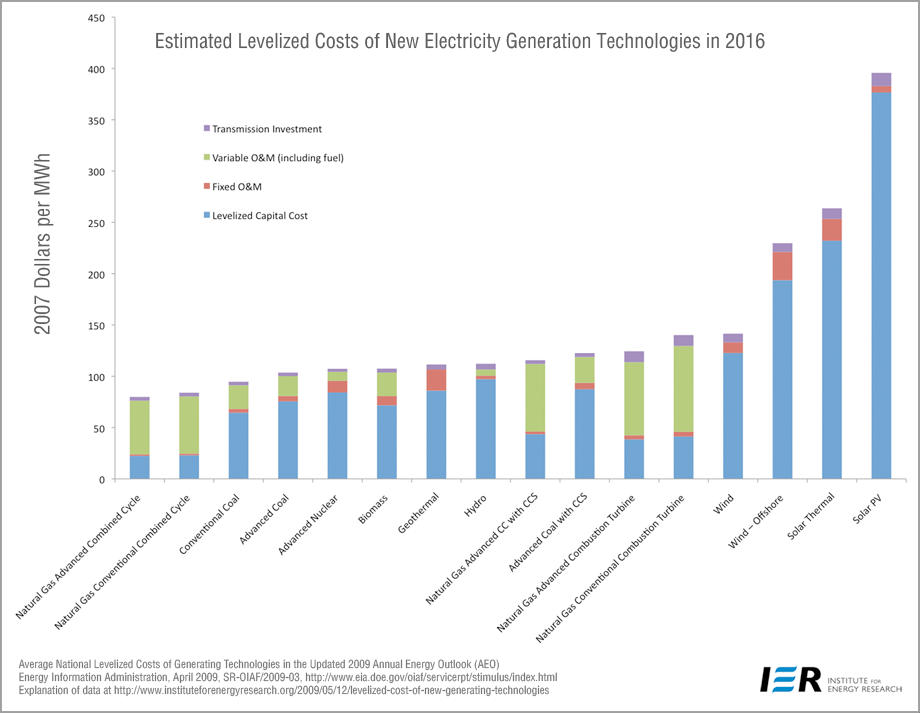

The electrical cost problem, identified by Citigroup is a different issue. Both the Energy Information Agency projections and the SCANA projections show that the long term projected costs for nuclear power, although high, is lower than their cost projections for renewables.

PV advocates bitterly object to this to the high estimates of PV cost, and insist that the cost of PV panels is going to rapidly sink to virtually nothing for vast amounts of power. Solar advocates have been telling us similar stories since the 1970's, and PV is still outrageously expensive. The PV industry is highly dependent on subsidies for their living, but the need the sky high costs are falling stories to justify more subsidies.

PV advocates bitterly object to this to the high estimates of PV cost, and insist that the cost of PV panels is going to rapidly sink to virtually nothing for vast amounts of power. Solar advocates have been telling us similar stories since the 1970's, and PV is still outrageously expensive. The PV industry is highly dependent on subsidies for their living, but the need the sky high costs are falling stories to justify more subsidies.

PV advocates bitterly object to this to the high estimates of PV cost, and insist that the cost of PV panels is going to rapidly sink to virtually nothing for vast amounts of power. Solar advocates have been telling us similar stories since the 1970's, and PV is still outrageously expensive. The PV industry is highly dependent on subsidies for their living, but the need the sky high costs are falling stories to justify more subsidies.

PV advocates bitterly object to this to the high estimates of PV cost, and insist that the cost of PV panels is going to rapidly sink to virtually nothing for vast amounts of power. Solar advocates have been telling us similar stories since the 1970's, and PV is still outrageously expensive. The PV industry is highly dependent on subsidies for their living, but the need the sky high costs are falling stories to justify more subsidies. In a some what longer term more advanced nuclear technology, holds the potential to bring nuclear costs down and lower the cost of electricity. The lure of lower electrical costs, should be enough to lure the advanced industrial states of North America, Eastern Asia, and Europe into investing in advanced nuclear R&W. I have repeatedly argued that a form of advanced nuclear technology that uses fuel dissolved in liquid salts holds the key to lowering nuclear costs. Policy makers should be highly motivated to uncover and sponsor research into such promising options, but as David Walters recently observed in a comment on Nuclear Green,

What is common about countries really engaged in nuclear energy deployment is the goals they really set for themselves: S. Korea, China and India. I expect Vietnam as well. These projects become points of national pride.The failure to develop promising nuclear technologies, which potentially hold the key to lowering energy costs, in the face of of an unprecedented global energy crisis is a matter of national shame. It is utterly shameful than the American Energy Secretary, a Nobel Prize winning physicist, is so poorly informed about this option. Unfortunately the United States and Western Europe face the current energy crisis without a since of national pride. We will pay a high cost for this failure to take pride in ourselves, for this failure to believe in ourselves, and the high cost of electricity will be the least of the costs we pay.

5 comments:

Charles, bus bar costs for CCGT in California right now is less that $30/mhr. Way less. I don't know where these number come from unless thy are Ca. gas prices circa 2000. I beleive the other ones but not the GT ones. Way too high.

David, As i understand it, the SCANA cost figures are a 40 year projection of costs. The SCANA graft suggests that if you were to choose natural gas rather than nuclear power for the next 40 years, this is our best guess about what it will cost.

Charles,

I rather reached the same conclusion by looking at the coal generation cost. They show it as higher than nuclear. I can only assume that SCANA has made an educated guess at a carbon tax or emission permit pricing.

Bill

OK, that makes more sense then. Of course predicting NG prices is not exactly a good futures bet.

David - I have some difficulty believing that the busbar cost in California is "way less" than $30 per megawatt hour. According to bloomberg.com for December 22, 2009, the firm, on peak spot price at Palo Verde is $47.37.

The listed price for natural gas at Henry Hub is $5.73 per million BTU. Even in the most efficient CCGT plants available running constantly at their absolute max efficiency (about 5,700 BTU per kilowatt-hour) - which are not all that common - the fuel price alone for natural gas heated power is $32 per megawatt hour at the Henry Hub price for gas.

There are other costs that need to be added to fuel costs in order to compute the total price that any vendor needs to have in order to sell electricity produced by burning gas and remain in business.

Is gas that much cheaper in CA?

Rod Adams

Publisher, Atomic Insights

Post a Comment